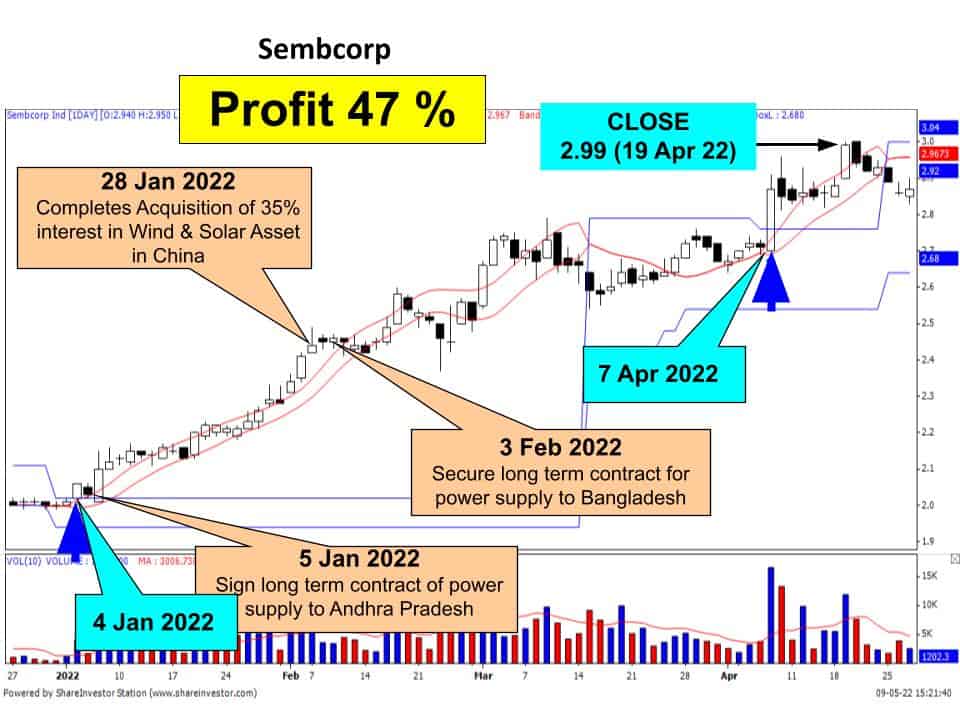

LOOK AT THESE CHARTS

Notice the blue arrows and double red lines -- That’s where our simple tool alerts us of profitable trading opportunities.

While we move towards the endemic status, the coast is not clear yet. Russia-Ukraine conflict and the rising interest rates are all bane to the long awaited economic recovery we're hoping for. It's not easier than before to find stocks that can still make some gains in this environment.

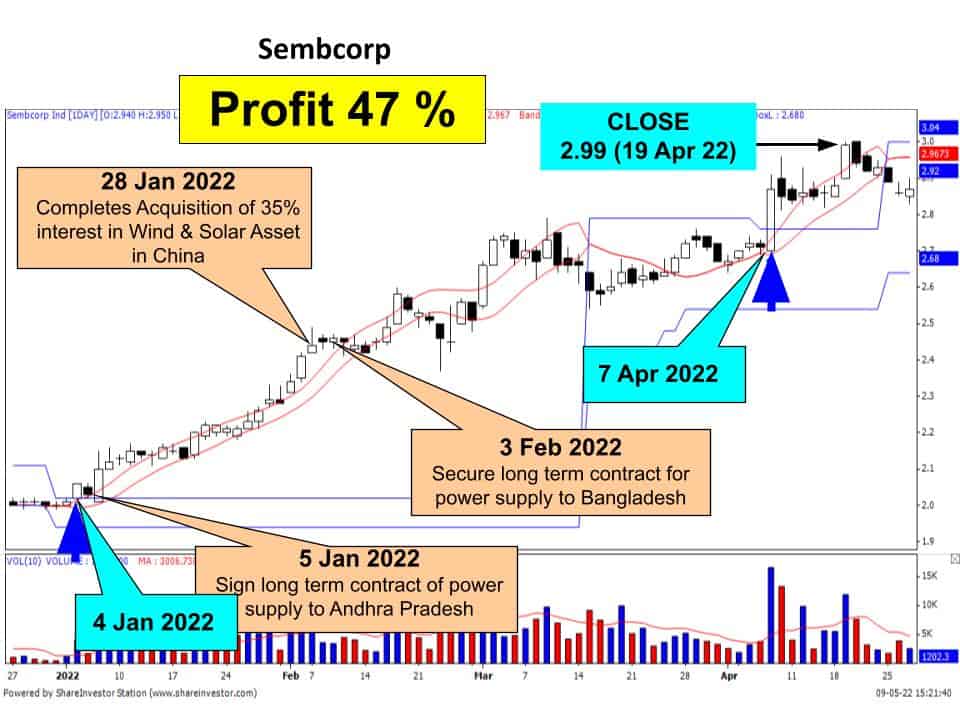

Fortunately, we managed to snag up a few outlier stocks such as Dyna-mac (whopping 145% gain), Keppel Corp, Frasers Hospitality Trust, City Dev, Sembcorp and more.

As seen in the charts above, we were alerted multiple times on different dates to make entries to specific stock - BEFORE positive news was announced to the public.

For example, Dyna-mac, a stock that was pretty much unknown to most retail investors, suddenly surged. We received an alert on 26 Apr 2022 that there were unusual activity and to get in. It was only much later in Jun 2022 that it was revealed by analysts that Dyna-mac made a huge winfall equivalent to 3 years worth of revenue. In less than 2 months, we managed to make a whopping 145% gain because of this.

In Keppel Corp's case, we were alerted on 14 Jan 2022 to make an entry. It was only after 2 weeks on 27 Jan that they announced a net profit surge to $1.02 billion and a $500 million buyback programme. We were alerted once again on 18 Mar 2022, almost 2 weeks before its definite agreement with Sembcorp Marine to divest logistics business. All in all, our students made 31% in profits.

Another stock that our trading system picked up before it became "hot" is Frasers Hospitality Trust. We were alerted on 24 Mar 2022 to enter. More than a month later, and more than 30% increase in stock price later, the REIT announced a 293% increase in DPS to $0.7039. In hindsight, it might look like a no-brainer, but when it was slowly climbing, investors and traders had no clue as to what caused the surge. In the end, our students made a handsome 36% in profits.

There were other stocks as well, and you can see in more charts below that we're "ahead of the market", getting alerts BEFORE any positive news was announced.

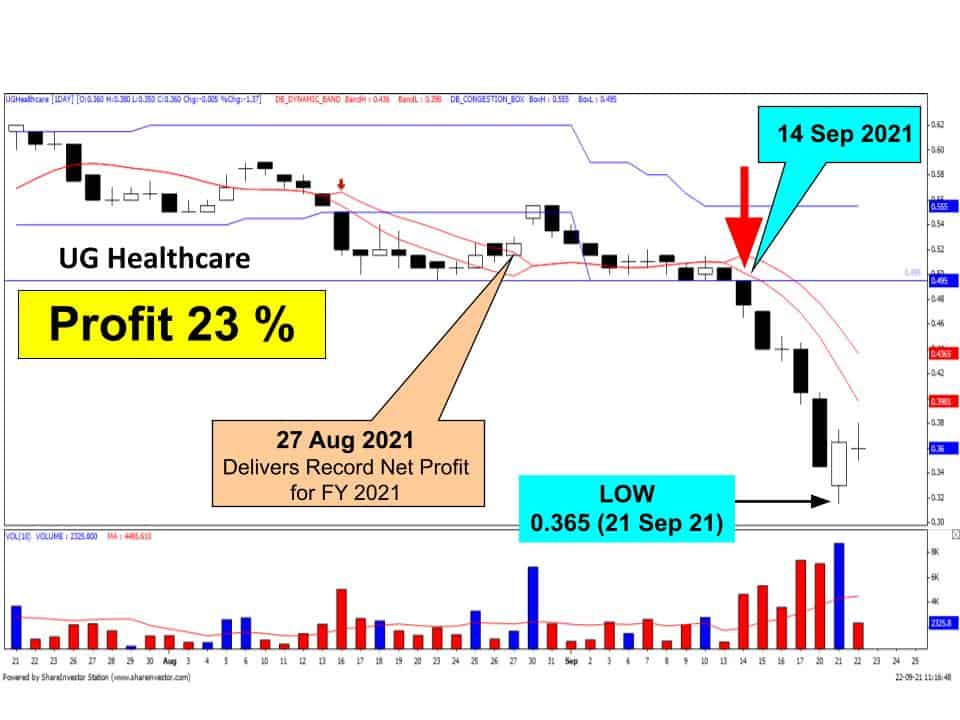

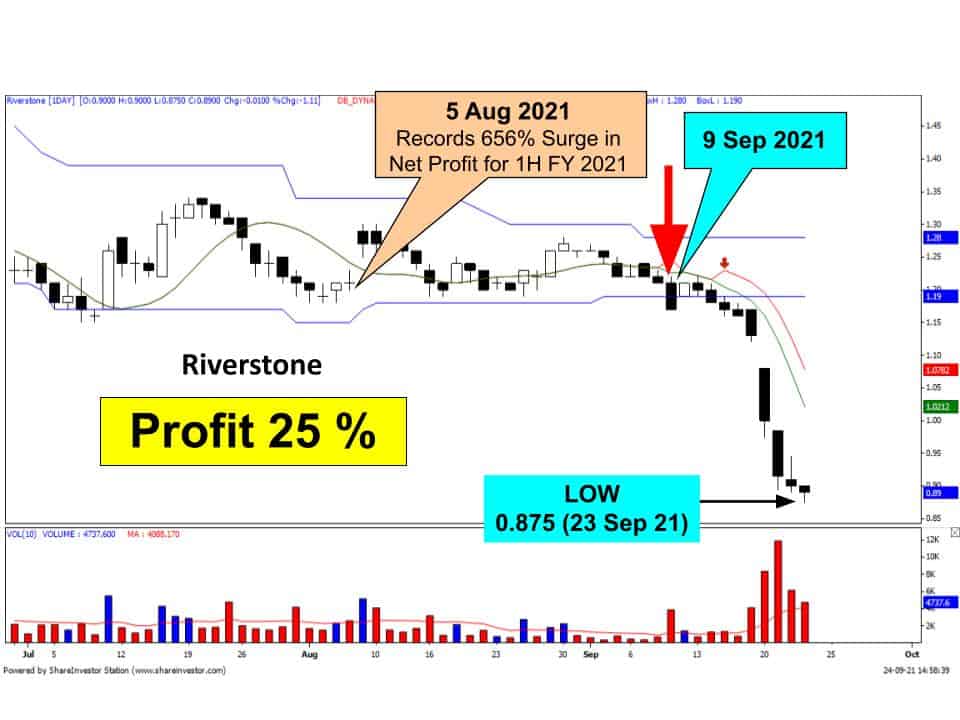

Also, our trading system works for short selling as well, especially during the sell-offs as the pandemic raged on.

Months ago when investors and traders rode the rollercoaster ride of a stock market because of the "yo-yo" trend of loosening and tightening of safety measures, many stocks suffered from multiple selldowns. Below are several charts of when our proprietary system picked up "unusual" movements in stock prices.

In particular, more recently, Golden Energy, which was a stock that made impressive gains but succumbed to a sell down DESPITE multiple "BUY" calls by analysts. UG Healthcare and Riverstone were other examples of stocks that record net profits but still experienced sell offs. In Top Glove's case, we were alerted a week before they reported a 48% drop in profit. As can be seen, our system is great at SHORT SELLING too.

What if you can get trading alerts like these amidst this crisis?